Case Study

Tradewise AI Algorithmic Trading

500k Account

Case Study

Tradewise AI Algorithmic Trading

500k Account

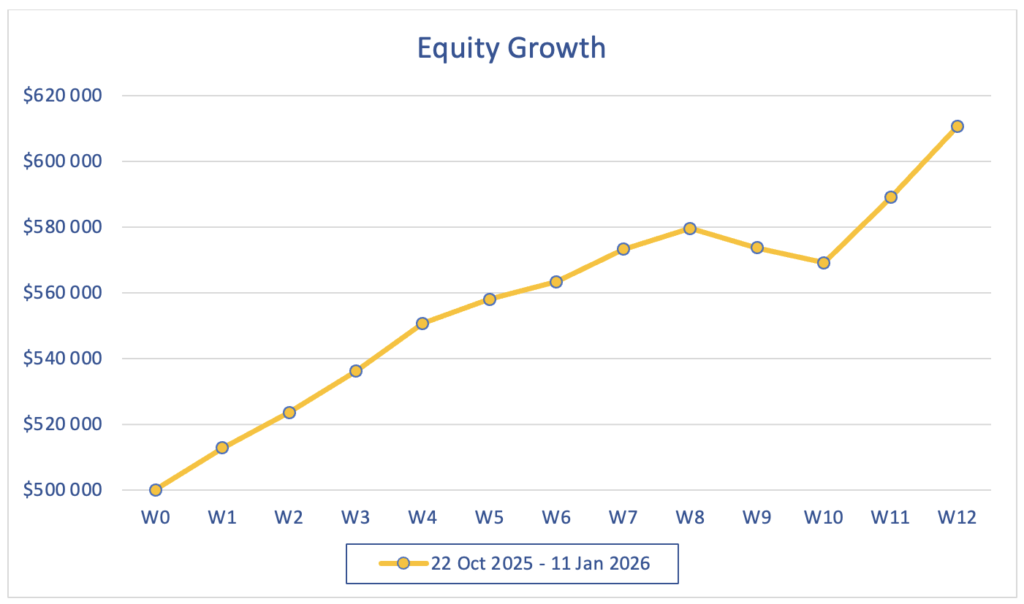

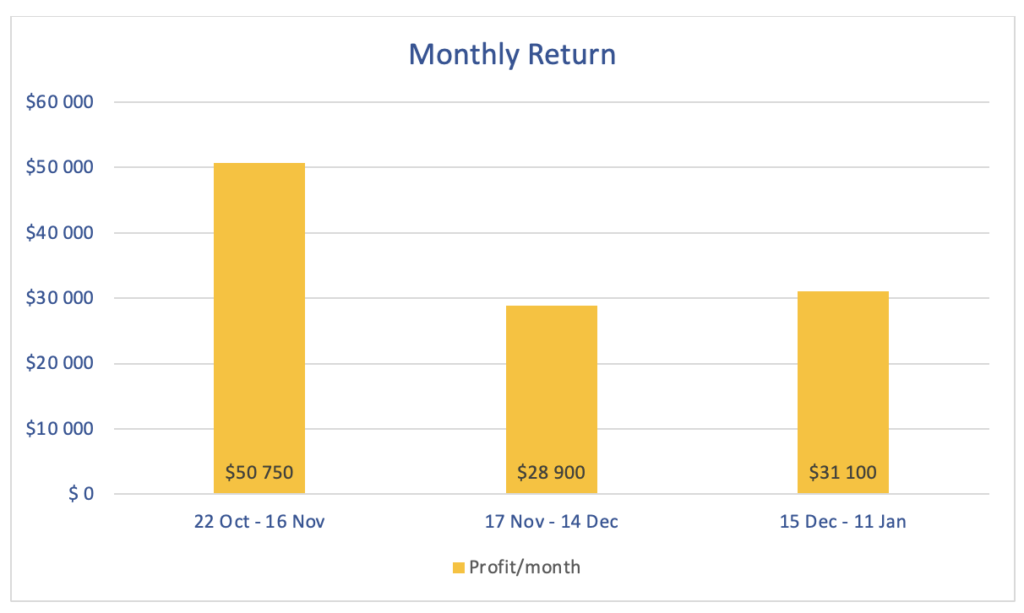

Tradewise AI system trades gold (XAUUSD) using autonomous scalping logic with strict risk control. The account compounded from $500,000 to $610,783 across three months, yielding a cumulative return of +22.15% while maintaining controlled drawdowns.

Performance In 3 Months

Initial Capital

Current Equity

Cumulative Return

$500,000

$610,783

22,15%

Initial Capital

$500,000

Current Equity

$610,783

Cumulative Return

22,15%

20 Oct - 16 Nov

+10.15%

17 Nov - 14 Dec

+5.78%

15 Dec - 11 Jan

+6.22%

How Risk Is Controlled

The system does not remain in the market continuously. It selectively participates during favorable liquidity and volatility conditions, and suspends trading around major news releases or unstable periods. Exposure is reduced when risk increases, and expanded only when probability aligns with strategy rules. This selective execution model helps limit drawdowns and protect capital during hostile environments. Returns are generated without dependence on aggressive leverage or constant trading, but through disciplined risk filtering, specialization, and consistent compounding over time.

How Returns Are Generated

The AI focuses on short-term scalping opportunities in gold (XAUUSD), where volatility creates brief, high-probability entry points. Returns are primarily generated during periods of clean price structure and sufficient institutional liquidity, while activity becomes more defensive during thin or unstable market conditions. This dynamic between offensive and defensive trading behavior supports consistency in performance and produces a smoother compounding effect over time.

Consistency Over Time

The system prioritizes stability over aggressive speculation. Its rules-based architecture produces repeatable trading behavior, independent of market sentiment or emotion. By maintaining uniform position sizing, controlled exposure, and selective participation, the strategy avoids the large equity swings common in discretionary or highly leveraged trading. Over time, this results in smoother compounding, reduced volatility of monthly outcomes, and a more predictable performance profile—qualities that are essential for long-term capital growth and investor confidence.