Introduction to Short Selling

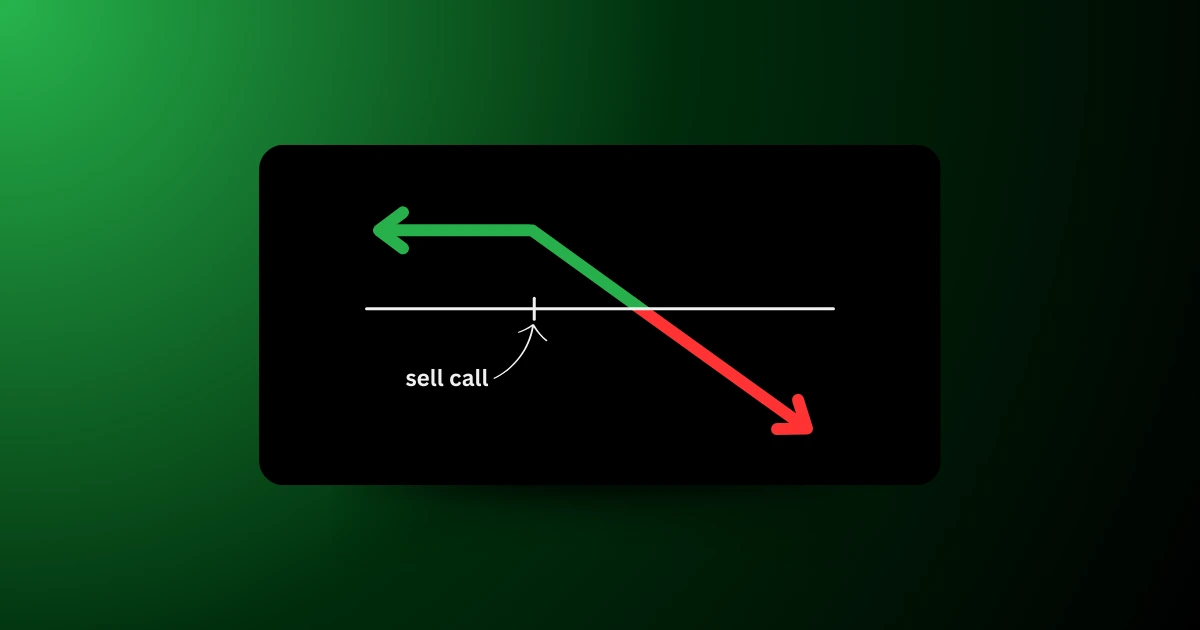

Short selling is a trading strategy that allows investors to profit from the decline in the price of a

security. While traditional investing involves buying a stock with the expectation that its price will

rise, short selling takes the opposite approach. In this method, an investor borrows shares of a

stock and sells them on the open market, planning to buy them back later at a lower price. If the

stock price falls as anticipated, the investor can repurchase the shares at the lower price, return

them to the lender, and pocket the difference as profit.

How Short Selling Works

- Borrowing Shares: The process begins with borrowing shares from a broker. These shares can

come from the broker’s own inventory, another client, or a lending firm. - Selling Borrowed Shares: Once borrowed, the shares are sold at the current market price. The

investor receives cash from this sale. - Waiting for Price Decline: The short seller waits for the stock price to drop. The duration of this

waiting period can vary based on market conditions and the investor’s expectations. - Buying Back Shares: The investor buys back the same number of shares at the lower price.

- Returning Shares: Finally, the shares are returned to the broker, and the difference between the

selling price and the buying price (minus any fees or interest) is the profit.

Example of Short Selling

Suppose an investor believes that Company XYZ, currently trading at $100 per share, is

overvalued. The investor borrows 100 shares and sells them for $100 each, receiving $10,000. A

month later, the stock price drops to $80 per share. The investor buys back 100 shares for $8,000,

returns them to the broker, and retains the $2,000 difference as profit (excluding fees and interest).

The Risks of Short Selling

While short selling can be profitable, it carries significant risks:

- Unlimited Loss Potential: Unlike buying stocks, where the maximum loss is limited to the initial

investment, short selling can result in unlimited losses. If the stock price rises instead of falling,

the short seller must buy back the shares at a higher price, leading to potentially infinite losses. - Margin Requirements: Short sellers must maintain a margin account with their broker, which

involves collateral and may require additional funds if the stock price rises. - Borrowing Costs: Short sellers pay interest on the borrowed shares, which can add up,

especially if the position is held for a long period. - Market Risks: Short selling involves timing the market, which is notoriously difficult. A stock may

remain overvalued for a longer period than the investor can remain solvent.

Regulations and Short Squeezes

Short selling is subject to regulatory scrutiny due to its potential impact on the market.

Regulations may include disclosure requirements and restrictions on short sales during volatile

periods.

A “short squeeze” occurs when a heavily shorted stock’s price starts to rise, prompting short

sellers to buy back shares to cover their positions. This buying pressure can drive the stock price

even higher, leading to rapid and substantial losses for short sellers. Notable examples include the

GameStop short squeeze in early 2021, where coordinated buying by retail investors led to

massive losses for institutional short sellers.

Conclusion

Short selling is a sophisticated trading strategy that offers the potential for significant profits but

comes with high risks. Investors considering short selling should fully understand the mechanics,

risks, and regulations involved. As with any investment strategy, thorough research, risk

management, and a clear understanding of market conditions are essential for success.

By comprehending the intricacies of short selling, investors can better navigate the complexities

of the stock market and make informed decisions that align with their financial goals.