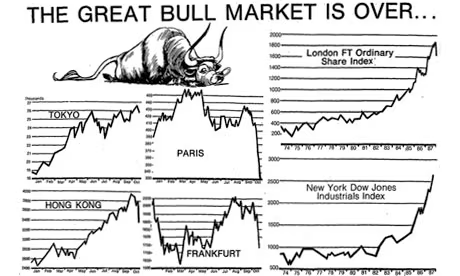

Black Monday refers to October 19, 1987, when global stock markets crashed, leading to

unprecedented losses in a single trading day. The Dow Jones Industrial Average (DJIA)

plummeted by 22.6%, marking the largest one-day percentage decline in its history. This event

sent shockwaves through financial markets worldwide, with significant drops in markets across

Asia and Europe as well.

What is Black Monday?

Causes of Black Monday

Several factors contributed to the Black Monday crash, creating a perfect storm that led to the

market meltdown:

- Program Trading: The widespread use of computer-driven program trading was a significant

factor. These automated trading systems, designed to execute large orders at specific price

points, triggered a cascade of sell orders when the market began to decline, exacerbating the

drop. - Portfolio Insurance: Many institutional investors used portfolio insurance strategies to hedge

against market declines. However, as markets fell, these strategies involved selling more futures

contracts, further driving down prices and creating a feedback loop that intensified the selling

pressure. - Overvaluation: In the years leading up to Black Monday, stock prices had risen sharply, leading

to concerns that the market was overvalued. This overvaluation made the market more vulnerable

to a correction.

4.Economic Concerns: There were growing worries about rising interest rates, inflation, and the

U.S. trade deficit. These economic concerns contributed to investor anxiety and a loss of

confidence in the market. - Geopolitical Tensions: Political and economic instability in various parts of the world also

played a role, adding to the uncertainty and prompting investors to reduce their exposure to

equities.

The Impact of Black Monday

The immediate impact of Black Monday was severe, with trillions of dollars in market value wiped

out in a matter of hours. The crash had several far-reaching effects:

- Market Reforms: The crash led to significant changes in market regulations and the

implementation of circuit breakers, designed to prevent future crashes of a similar magnitude.

These circuit breakers temporarily halt trading if prices decline too sharply, giving investors time to

assess the situation and make more measured decisions. - Investor Behavior: Black Monday profoundly impacted investor psychology, instilling a greater

awareness of the risks associated with program trading and automated systems. It also

highlighted the importance of diversification and risk management in investment strategies. - Economic Consequences: While the crash itself did not lead to a prolonged economic

downturn, it did contribute to a period of economic uncertainty and caution in financial markets.

The Federal Reserve and other central banks took measures to stabilize the markets and restore

confidence. - Global Markets: The crash underscored the interconnectedness of global financial markets. The

rapid spread of the market decline across different regions highlighted the need for better

coordination among international financial authorities.

Lessons from Black Monday

Black Monday serves as a stark reminder of the potential for sudden and severe market

disruptions. Key lessons from this event include:

- Risk Management: The importance of robust risk management strategies cannot be overstated.

Investors should be prepared for market volatility and have plans in place to mitigate potential

losses. - Market Mechanisms: The crash led to improvements in market mechanisms, such as circuit

breakers and enhanced communication between exchanges, which help prevent similar crashes. - Investor Education: Educating investors about the risks and dynamics of the market can help

them make more informed decisions and avoid panic selling during periods of volatility.

Conclusion

Black Monday remains one of the most significant events in stock market history, highlighting the

fragility of financial markets and the potential for rapid and severe declines. Understanding the

causes and consequences of this crash can help investors and regulators better navigate future

market challenges and work towards a more stable and resilient financial system.